Financial Transparency

Welcome to Lubbock County’s Financial Transparency web page. Lubbock County is commented to proving the public with significant financial information in a way that is meaningful and clear with easy to use financial data. This page contains financial disclosures for Traditional Finances by providing the County’s adopted budget, the annual financial report, and the expenses through check registers. By posting these financial documents, charts and data in raw format, it is our desire to foster transparency and accountability while allowing the citizens of Lubbock County to be informed on financial operations. Financial operations that include services provided and spending decisions which occur in our local government.

The Government Finance Officers Association of the United States and Canada (GFOA) awarded a Certificate of Achievement for Excellence in Financial Reporting to Lubbock County for its Annual Comprehensive Financial Report for the Fiscal Year Ended 2021. This award of achievement recognizes that the County’s annual financial report has had an annual audit performed by an independent auditor in accordance with the Generally Accepted Accounting Principles (GAAP) and the Governmental Accounting Standards Board (GASB).

Transparency Stars - The Texas Comptroller of Public Accounts encourages local governments to go above and beyond in their efforts to provide financial information to the public. Local governments may achieve a transparency star in traditional finances, contracts and procurement, economic development, public pensions, debt obligations. In June 2021, Texas Comptroller Glenn Hegar announced Lubbock County has achieved specific transparency goals in Traditional Finances. The County was awarded its first transparency star through the Comptroller's Transparency Stars program for our accomplishments.

Traditional Finances- Transparency Summary

Entity: Lubbock County

Type of Entity: County

Most recently completed fiscal year,

10/01/2021 -09/30/2022

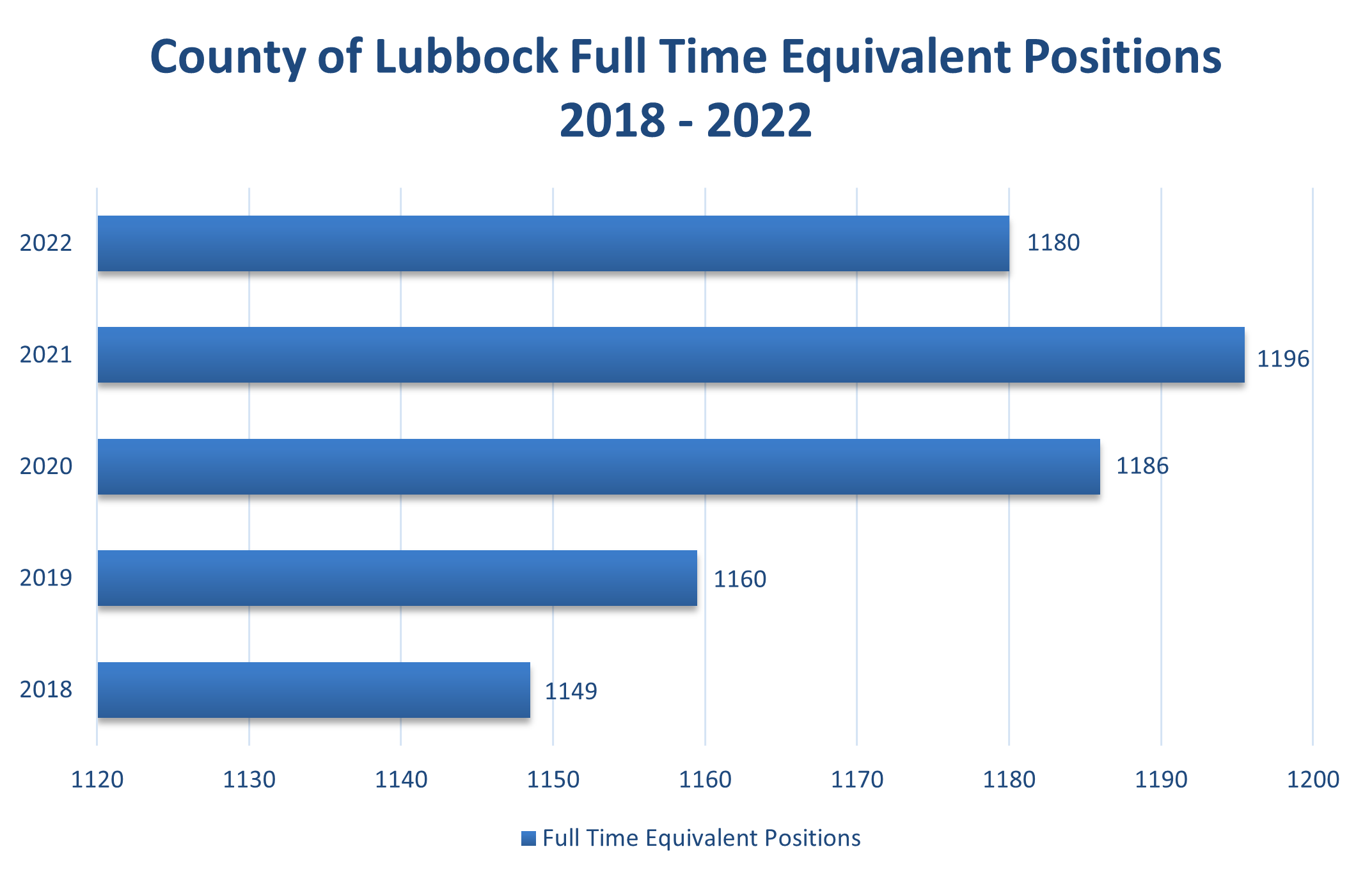

Staffing

Total full-time equivalent positions for all personnel in the most recently completed fiscal year: 1,180

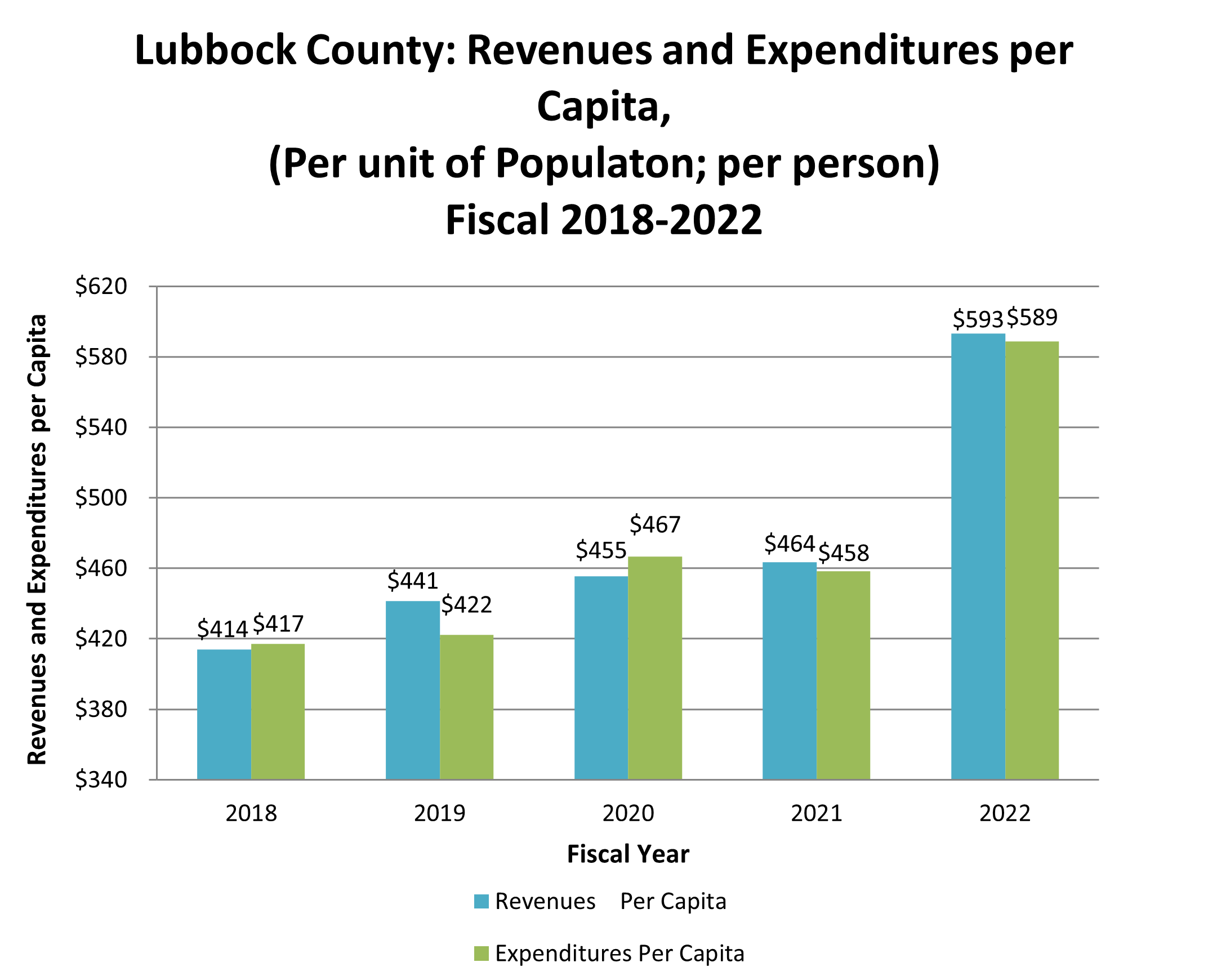

Expenditures

Total expenditures for most recently completed fiscal year: $185,106,939

Total expenditures per capita for most recently completed fiscal year: $589

Source: https://www.census.gov/quickfacts/lubbockcountytexas Year for population: 2021

Revenues

Total revenue from all funds for the most recently completed fiscal year: $186,482,135

Total revenue from all funds expressed as per capita amount for the most recently completed fiscal year: $593

Total property tax revenue for the most recently completed fiscal year: $85,379,931

Total revenues from property taxes expressed as per capita amount for the most recently completed fiscal year: $272

Total sales tax revenue for the most recently completed fiscal year: $34,750,684

Total sales tax revenue expressed per capita amount for the most recently completed fiscal year: $111

Charts

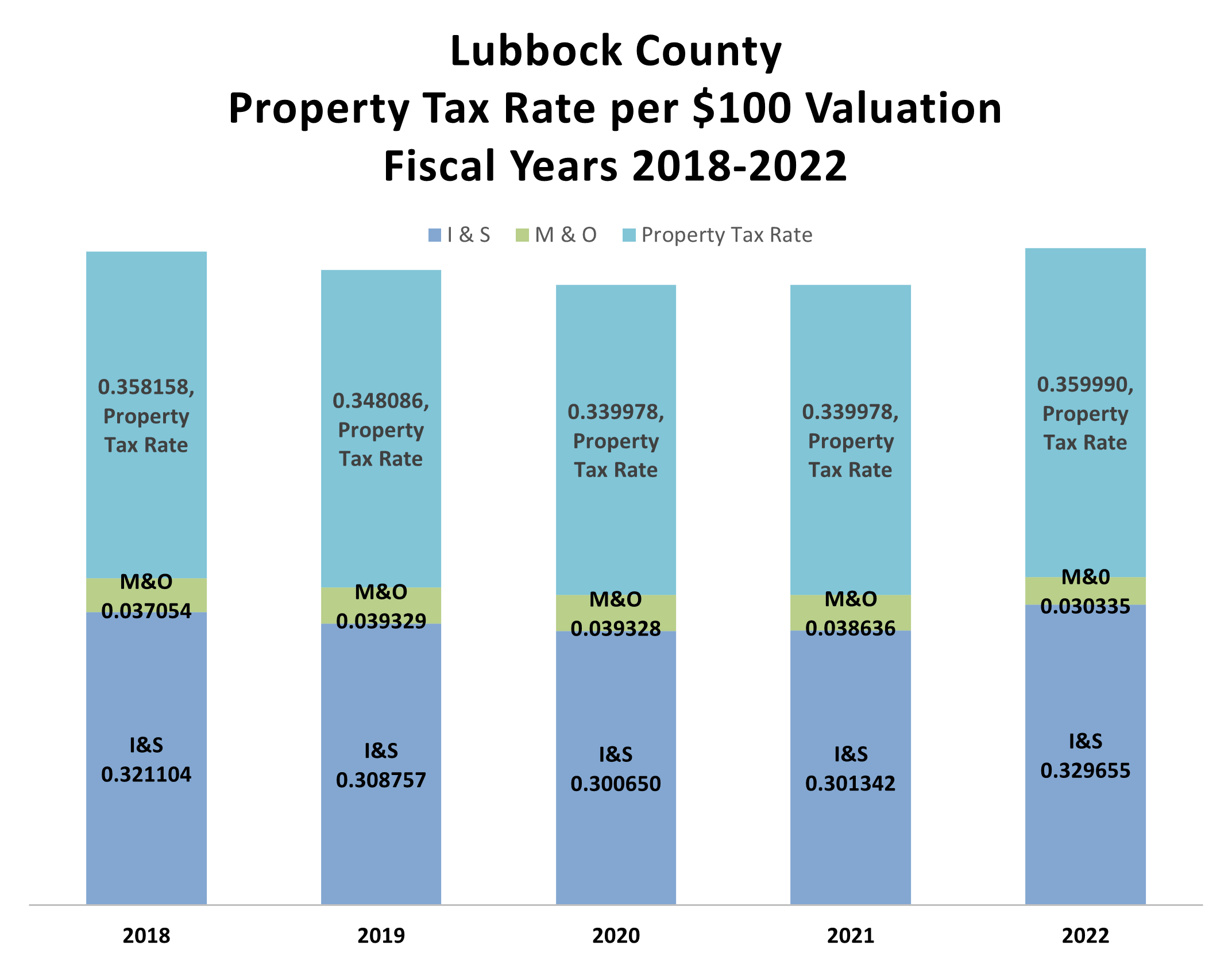

Note: Tax Rate is per $100 valuation and includes the Maintenance and Operations (M&O) tax rate and an Interest & Sinking (I&S) tax rate. The M&O tax rate –provides funds for the maintenance and operation for an entity. Whereas an I&S tax rate provides funds for the payments on the debt that finances an entity’s facilities and infrastructure.

Documents

|

Annual Budget: Proposed spending and revenue, shown in broad categories by office/department and by account type. A budget serves as the financial plan for the county. Annual Comprehensive Financial Report: A comparison of budgeted to actual expenses and revenues. A financial report demonstrates how well the county managed within the proposed budget and plan. |

Downloadable Data

Raw Format Annual Budget: Proposed spending and revenue, shown by line item by office/department and by account type in raw format.

Raw Format Expenditure Check Register: Listing of expenses showing to whom payment was made, payment date, payment number, account number, account name, payment description and payment amount. "All purchases are made in compliance with the Texas Local Government Code (LGC), other relevant law and best business practices."

Raw Format Salary Report: Listing of gross salary expenses with description, by date, fund, department and line item.

Other Financial Information

Monthly Unaudited Financial Report: Reports showing Financial Statements, Schedules, Budget Status, Funds on Deposit, Bonded Indebtedness, and other financial information.

Utility Bills: Listing of expenses paid for utilities (gas & electricity) showing the vendor, service address, billing period, usage and amount paid.

Current Tax Rates: Overview of the current rates of property and sales taxes imposed by Lubbock County. Lubbock Central Appraisal District /

Texas Comptroller Website

Debt Information

The County issued Unlimited Tax Road Bonds, Series 2019 on September 26, 2019 to be used for construction, maintenance, and operations of macadamized, graveled or paved roads and turnpikes, or in aid thereof, throughout the County and to pay professional services and the costs of issuance related to the bonds.

The County issued Special Tax Revenue Bonds 2020 on June 11, 2020 from a voter-approved venue tax comprised of hotel occupancy tax and a short-term rental tax. These taxes are collected to finance this debt service for the purpose of a County Expo Center.

The County issued Unlimited Tax Road Bonds, Series 2020 on November 19, 2020 to be used for construction, maintenance, and operations of macadamized, graveled or paved roads and turnpikes, or in aid thereof, throughout the County and to pay professional services and the costs of issuance related to the bonds.

The County issued General Obligation Refunding Bonds, Series 2021 on December 16, 2021 to refund the County's outstanding Certificates of Obligation, Series 2013 in order to lower the overall debt service requirements of the County.

The County issued Unlimited Tax Road Bonds, Series 2023A on March 14, 2023 to be used for construction, maintenance, and operations of macadamized, graveled or paved roads and turnpikes, or in aid thereof, throughout the County and to pay professional services and the costs of issuance related to the bonds.

The County issued Unlimited Tax Road Bonds, Series 2023B on September 28, 2023 to be used for construction, maintenance, and operations of macadamized, graveled or paved roads and turnpikes, or in aid thereof, throughout the County and to pay professional services and the costs of issuance related to the bonds.

Contact Information

Main

Lubbock County Courthouse

906 Broadway

Lubbock, TX 79401

806-775-1000

Mailing Address

Lubbock County Courthouse

P.O. Box 10536

Lubbock, TX 79408

County Auditor

Kathy Williams

916 Main, Suite 700

Lubbock, TX 79408

806-775-1097

Public Information Request

THE PUBLIC INFORMATION ACT

Texas Government Code, Chapter 552, gives you the right to access government records; and an officer for public information and the officer’s agent may not ask why you want them. All government information is presumed to be available to the public. Certain exceptions may apply to the disclosure of the information. Governmental bodies shall promptly release requested information that is not confidential by law, either constitutional, statutory, or by judicial decision, or information for which an exception to disclosure has not been sought.

Procedures to Obtain Information

- Submit a written request by mail, e-mail, or in person to the County Department from which the information is sought.

- Include enough description and detail about the information requested to enable the County to accurately identify and locate the information requested.

- Cooperate with the County’s reasonable efforts to clarify the type or amount of information requested.

CLICK HERE for a summary of the Rights of Requestors and the Responsibilities of Governmental Bodies under Texas Government Code, Chapter 552.

For complaints regarding failure to release public information please contact:

Lubbock County Criminal District Attorney’s Office

ATTN: Civil Division, Open Records

P.O. Box 10536

Lubbock, TX 79408-3536

You may also contact the Office of the Attorney General, Open Records Hotline, at 512-478-6736 or toll-free at 1-877-673-6839.

For complaints regarding overcharges, please contact the Office of the Attorney General’s Cost Rules Administrator at 512-475-2497